Best cash back credit cards are an enticing option for the financially astute, promising rewards for everyday purchases that can significantly enhance your spending power. These cards operate on a simple premise: you earn a percentage of your spending back in cash, a concept that resonates well with both the casual shopper and the financial strategist alike. With various rewards structures and enticing perks, they transform routine expenses into opportunities for savings, making them a popular choice amongst consumers looking to maximise the value of their expenditures.

As we delve deeper, we’ll explore the top contenders currently available, dissecting their rewards percentages, annual fees, and unique features to help you make an informed decision. With a glance at customer reviews and a thorough understanding of the essential factors to consider, we aim to equip you with the knowledge necessary to navigate the exhilarating landscape of cash back credit cards.

Overview of Cash Back Credit Cards

Cash back credit cards have emerged as a popular financial tool, providing users the opportunity to earn a percentage of their expenditures back in cash. This straightforward yet effective incentive encourages consumers to use their cards for everyday purchases, turning mundane spending into a source of savings. Understanding how these cards operate and the benefits they offer can greatly enhance one’s financial strategy.

Cash back credit cards operate on a simple premise: for every pound spent, a set percentage is returned to the cardholder as cash back. Typically, this percentage can range from 1% to 5%, depending on the spending category and the specific card. Most cards offer a tiered rewards structure, where different categories of spending earn varying rates of cash back. For instance, a card may give 5% cash back on groceries, 3% on fuel, and 1% on all other purchases. Additionally, some cards provide a sign-up bonus, offering a substantial cash back reward if a certain spending threshold is met within the first few months of using the card.

Benefits of Using Cash Back Credit Cards

Using cash back credit cards for everyday purchases presents numerous advantages, making them a beneficial option for many consumers. The primary benefit is the ability to earn money back on spending that would occur regardless. This transforms routine transactions, such as grocery shopping or fuel refills, into opportunities for savings.

Moreover, cash back credit cards often come with additional perks, such as no annual fees, travel insurance, or purchase protection. Below are some key benefits of employing these cards effectively:

- Enhanced Budgeting: Many cash back cards provide detailed statements and spending trackers, which aid in budgeting and managing finances.

- Flexibility in Rewards: Cash back can often be redeemed in various ways, including direct bank deposits, statement credits, or gift cards, allowing for flexibility in how rewards are used.

- No Restrictions on Spending: Unlike points-based rewards systems, cash back offers a straightforward return on all eligible purchases, making it easy to understand value.

- Promotional Offers: Certain cards may provide higher cash back rates during promotional periods or for particular merchants, increasing the potential for rewards.

- Improved Financial Discipline: The incentive to earn cash back can encourage more conscious spending and a focus on maintaining a budget.

In summary, cash back credit cards not only reward users for their spending but also provide beneficial tools for managing finances and making informed purchasing decisions.

Top Cash Back Credit Cards Available

In the ever-evolving landscape of personal finance, cash back credit cards stand out as popular options for consumers looking to earn rewards on their everyday spending. With various offerings available, it is crucial to identify which cards provide the best value, features, and unique perks. This segment will delve into the top cash back credit cards currently on the market, providing a comprehensive comparison to aid in making informed decisions.

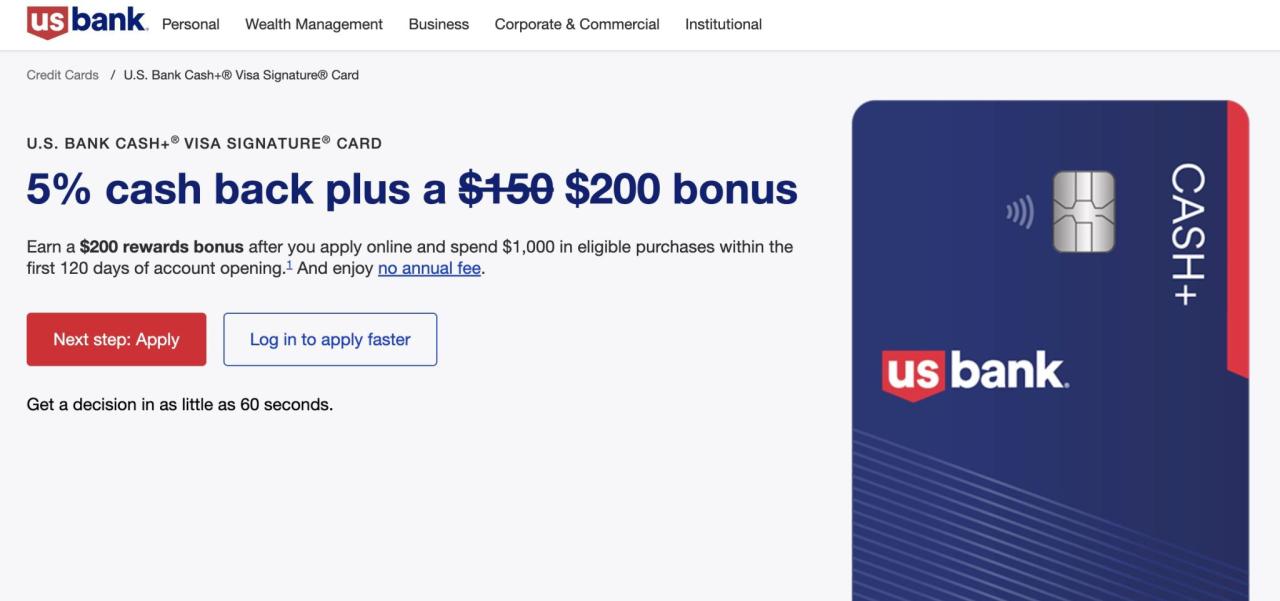

Cash back credit cards reward users with a percentage of their spending returned, making them appealing for those who frequently make purchases. As we examine the leading options for 2023, key features such as rewards percentages, annual fees, and sign-up bonuses will be highlighted to showcase the distinct advantages of each card.

Comparison of Top Cash Back Credit Cards

The table below illustrates a comparison of some of the top cash back credit cards, focusing on crucial aspects that can influence your choice.

| Card Name | Rewards Percentage | Annual Fee | Sign-Up Bonus |

|---|---|---|---|

| Card A | 1.5% on all purchases | £0 | £100 after spending £500 in the first 3 months |

| Card B | 5% on groceries, 1% on everything else | £20 | £150 after spending £1,000 in the first 3 months |

| Card C | 1% on all purchases, 2% on online shopping | £0 | £75 after spending £300 in the first 3 months |

| Card D | 3% on travel, 1% on everything else | £30 | £200 after spending £1,500 in the first 3 months |

This comparison clearly Artikels the various cash back percentages and offers available, providing insight into which card may best suit individual spending habits and financial goals.

Best Cash Back Credit Cards for 2023

Several standout cash back credit cards have garnered attention for their unique features and exceptional rewards. Highlighted below are some of the best options available this year, each offering distinct benefits to cardholders.

- Card A: Ideal for those who prefer simplicity, offering a flat 1.5% cash back on all purchases with no annual fee.

- Card B: Perfect for grocery shoppers, providing an impressive 5% cash back on grocery purchases, making it a smart choice for families.

- Card C: Appeals to online shoppers with 2% cash back on online purchases, alongside a competitive 1% on all other transactions.

- Card D: Best for travel enthusiasts, offering 3% cash back on travel-related expenses, alongside generous sign-up rewards.

These options cater to a range of spending habits, ensuring that there is a cash back card for everyone.

Customer Reviews Summary

Customer feedback plays a vital role in assessing the effectiveness and satisfaction associated with various cash back credit cards. A summary of reviews for the aforementioned cards shows notable trends and preferences among users.

- Card A: Users appreciate the straightforward rewards system and the lack of an annual fee, which simplifies budgeting.

- Card B: Highly praised for its generous cash back on groceries, many users report significant savings over the year.

- Card C: Customers enjoy the elevated rewards for online shopping, citing it as beneficial in the current e-commerce-driven market.

- Card D: Users highlight the exceptional travel rewards and the value of the sign-up bonus, making it a popular choice for frequent travellers.

These insights provide a deeper understanding of the customer experience associated with these top-rated cash back credit cards, allowing potential users to make an informed choice based on real-life user satisfaction.

Factors to Consider When Choosing a Cash Back Card: Best Cash Back Credit Cards

Selecting the right cash back credit card necessitates careful consideration of various factors tailored to individual financial habits and lifestyle choices. A cash back card that suits one consumer may not be the best fit for another, hence understanding the nuances of these cards is crucial for maximising benefits. In this section, we will explore the key factors that play a significant role in the selection process, alongside the impact of spending habits and the importance of comprehending the associated terms and conditions.

Evaluation of Key Factors

When contemplating which cash back credit card to choose, several pivotal factors must be evaluated to ensure it aligns with one’s financial goals. These factors include:

- Cash Back Rates: Not all cash back cards offer the same rate of return. Some may provide a higher percentage for specific categories like groceries or dining, while others offer a flat rate across all purchases. Understanding these rates is essential for maximising rewards.

- Annual Fees: While some cash back cards come with no annual fee, others may charge a fee that could potentially offset the cash back earned. It is vital to assess whether the rewards justify any associated costs.

- Sign-Up Bonuses: Many cash back cards entice new customers with sign-up bonuses, often requiring a minimum spend within the first few months. Knowing these requirements can influence decisions, especially if significant expenses are anticipated shortly.

- Redemption Options: Cash back can typically be redeemed in various forms, such as statement credits, bank transfers, or gift cards. Understanding the flexibility and ease of redemption can significantly enhance the overall experience.

- Foreign Transaction Fees: For those who travel frequently, it is crucial to check for foreign transaction fees, which could diminish the value of cash back earned overseas. Opting for a card with no such fees can be advantageous.

Impact of Spending Habits

Consumer spending habits largely dictate the type of cash back card that may be most beneficial. Tailoring a card to fit these habits can lead to maximised rewards. For instance:

- Category Spending: Identifying where most of your spending occurs—be it dining, travel, groceries, or retail—can guide your choice in selecting a card that offers higher cash back in those areas. For instance, a card with 5% cash back on groceries is ideal for a family that shops frequently at supermarkets.

- Monthly Budget: Understanding your average monthly expenditures across different categories can assist in choosing a card that not only rewards but complements your financial management. For example, if one typically spends significantly on fuel, selecting a card that offers enhanced rewards for fuel purchases would be prudent.

- Payment Habits: If you consistently pay off your balance in full, you can afford to choose cards with higher interest rates in exchange for better cash back rewards. However, if you tend to carry a balance, it’s wise to consider the balance between rewards and interest rates.

Understanding Terms and Conditions

Knowledge of the terms and conditions associated with cash back rewards is paramount for avoiding pitfalls and ensuring that one fully understands how to leverage the card effectively.

- Expiry of Rewards: Many cards impose expiry dates on cash back rewards. Knowing when rewards expire can prevent the loss of accumulated benefits.

- Limitations on Earning: Some cash back cards have caps on how much cash back can be earned during a specific period (monthly or annually). Awareness of these limits can aid in effective planning to maximise rewards.

- Changes to Terms: Credit card issuers may alter their reward structures or terms. Regularly reviewing the terms can help consumers stay informed and reassess whether their card remains the best option.

Strategies to Maximize Cash Back Rewards

Maximising cash back rewards from your credit card can significantly enhance your financial flexibility, allowing you to earn while you spend. With the right strategies, you can ensure that every pound is put to its optimal use, converting routine purchases into substantial savings that can be redeemed later. Understanding how to navigate this landscape effectively will not only increase your rewards but also enhance your overall spending experience.

Utilising cash back credit cards effectively involves more than simply making purchases; it requires strategic planning and awareness of your spending habits. To truly maximise your rewards, it’s essential to focus on specific spending categories that yield higher returns, track your cash back earnings diligently, and ensure you are aware of the best redemption strategies available.

Common Spending Categories for High Cash Back, Best cash back credit cards

Identifying the spending categories that yield the highest cash back is paramount to maximising your rewards. Many cash back cards offer varying rates depending on the type of purchase, and being mindful of these categories can lead to substantial rewards over time. The following are categories that typically offer increased cash back percentages:

- Groceries: Most cash back cards offer elevated rewards for grocery purchases, often ranging from 1% to 5%. This category often represents a significant portion of monthly expenses, making it a prime target for maximisation.

- Gas Stations: Fuel purchases are another key category where many cards provide enhanced rewards, sometimes exceeding 3% cash back. Given the frequency of filling up, this can equate to sizeable returns.

- Dining: Eating out or ordering takeaway can yield high cash back rates, particularly with cards tailored towards food and drink purchases, often in the range of 2% to 4%.

- Online Shopping: Many cards also offer increased cash back for online retailers, particularly during promotional periods or partnerships. Keeping an eye out for these offers can yield great benefits.

- Utility Bills: Regular payments for utilities can also be a source of cash back, with some cards offering significant rates for monthly bills.

Being aware of these categories and aligning your spending habits accordingly can significantly enhance your cash back earnings.

Tracking Cash Back Earnings and Redemption Options

Tracking your cash back earnings is essential to ensure you are capitalising on your credit card’s features. Many card providers offer user-friendly apps and online portals that allow you to monitor your spending and rewards in real-time. Regularly checking your cash back balance can help you strategise future purchases and ensure that you are always optimising your spending.

Furthermore, understanding the various redemption options available can dramatically influence the value of your rewards. Common redemption options include:

- Statement Credits: This allows you to apply your cash back directly to your credit card bill, effectively reducing your overall balance.

- Gift Cards: Many credit card providers offer the option to redeem cash back for gift cards to popular retailers, often providing additional bonuses.

- Direct Deposits: Some cards may allow you to transfer your cash back directly to your bank account, providing immediate liquidity.

- Charitable Donations: A few providers also offer the option to donate your cash back to charity, allowing you to support causes you care about while enjoying the benefits of your spending.

By diligently tracking your earnings and understanding the best redemption options, you can maximise the utility of your cash back rewards, ensuring that your spending translates into tangible benefits.

When considering your options for protection against unforeseen medical expenses, it’s crucial to evaluate various health insurance companies. These providers offer a myriad of plans tailored to meet diverse needs. Concurrently, if you’re embarking on a building project, selecting the right construction company can dramatically influence the overall success and quality of your venture, ensuring that both health and safety standards are met throughout the process.

For anyone navigating the complexities of modern life, understanding the role of health insurance companies is essential. They provide a safety net against high healthcare costs, which can be particularly beneficial during unexpected health crises. In a similar vein, if you’re planning a major overhaul or new build, enlisting a reputable construction company ensures that your project adheres to all necessary regulations while achieving your desired aesthetic.